- Write by:

-

Tuesday, January 26, 2021 - 12:41:10 PM

-

558 Visit

-

Print

Mining News Pro - Sherritt International (TSX: S) on Monday reported its production results for full-year 2020, and also provided guidance for expected production, unit costs and capital spending in 2021.

Finished nickel production at the Moa joint venture in Cuba (50% owned) was 31,506 tonnes on a 100% basis, largely in line with guidance of 32,000-33,000 tonnes for the year. Finished cobalt production at the Moa JV was 3,370 tonnes on a 100% basis, consistent with guidance for the year.

Nickel and cobalt production in 2020 were negatively impacted by railway service disruptions in Q1, an extended plant shutdown in Q3 due to additional found work scope and reduced contractor availability due to covid-19, and by unplanned repairs to autoclaves in Q4.

Production totals achieved at the Moa JV in 2020 benefitted from additional health and safety measures implemented in Q1 to prevent the spread of covid-19, Sherritt said.

In 2021, nickel and cobalt production at the Moa JV are forecasted at between 32,000-34,000 tonnes and 3,300-3,600 tonnes, respectively. Anticipated production for 2021 is consistent with initial guidance for 2020 and recent performance at the Moa JV, and reflective of the ongoing commitment to operational excellence and employee health and safety, Sherritt said.

Net direct cash costs (NDCC) at the Moa JV are forecasted at between $4.25-$4.75 per pound of finished nickel sold, marginally above 2020 guidance due to higher forecasted input commodity prices.

Net direct cash costs include byproduct credits and input commodities that are subject to considerable change given the volatility of cobalt, fertilizers, crude oil, natural gas and sulphur prices. Forecasted NDCC for 2021 is also subject to the seasonality of fertilizer sales, which are typically higher in the second and fourth quarters, the miner said.

NDCC guidance for 2021 is based on a forecast cobalt reference price of $15.58 per pound and a forecast average sulphur price of $145 per tonne including freight and handling.

Sherritt’s share of capital spending at the Moa JV and at the Fort Site is forecasted at $44 million in 2021.

Shares of Sherritt International fell 8.5% by 12:30 p.m. in Toronto. The company’s market capitalization currently stands at C$192.68 million.

Short Link:

https://www.miningnews.ir/En/News/610208

A key measure of Chinese copper demand just sank to zero, another indication that global prices are not balanced with ...

Iron ore futures prices ticked lower on Monday, weighed down by diminishing hopes of more stimulus in top consumer ...

Interros, Nornickel’s largest shareholder, on Monday called allegations by fellow shareholder Rusal about undervalued ...

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

French mining group Eramet said on Wednesday it had reached an agreement with the French government to continue its ...

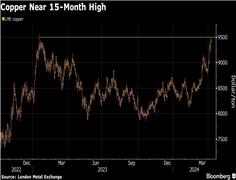

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

No comments have been posted yet ...