- Write by:

-

Friday, February 21, 2020 - 1:09:26 PM

-

598 Visit

-

Print

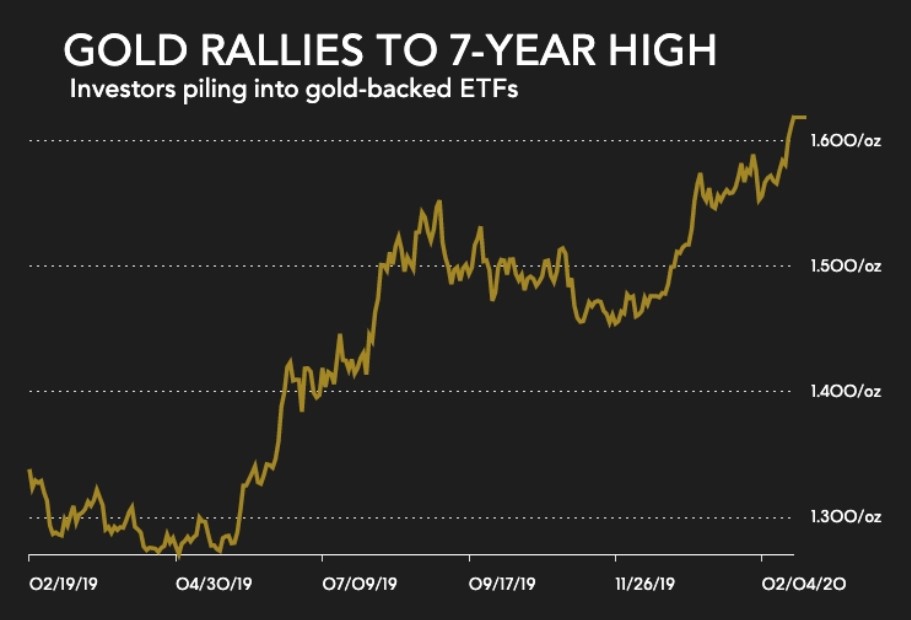

Mining News Pro - Six straight sessions of gains pushed the gold price to a 7-year high on Thursday as retail investors and hedge funds continue to pile into the metal, as a safe haven asset.

According to Mining News Pro - The gold price touched a new intra-day high of $1,626.50 on the Comex market in New York in another heavily traded session of more than 37m ounces by mid-afternoon.

Gold is up more than $100 since the start of 2020 and should the metal close above $1,620 an ounce it will be the highest level since mid-February 2013.

The gold price usually moves in the opposite direction of the US dollar, but gold’s rise this year has come about despite the strength in the greenback, which is at multi-year highs against major currencies.

Rising stock prices also act as a brake on gold price gains as investors move money into equities, but in 2020 gold’s rise is happening at the same time that Wall Street is testing all-time highs.

Ole Hansen, head of commodity strategy at Saxo Bank, says in a research note that during January total holdings in physically-backed gold exchange-traded funds, already at record highs, rose by an average of 1.3 tonnes per day.

So far this February holdings have – despite dollar strength and recovering markets – been rising by 1.9 tonnes per day according to Hansen:

Large-scale investors like hedge funds or so-called ‘managed money’ speculating in gold futures have also gone long gold.

Hansen points out hedge funds have maintained a net-long position (bets that gold prices will rise) of between 20 million to 30 million ounces since last October.

The latest breakout is likely to attract fresh momentum buying, which will be added to the 229,369 lots (22.9 million ounces) they held during the latest reporting week to February 11.

Short Link:

https://www.miningnews.ir/En/News/490927

China’s Zhaojin Mining Industry said on Wednesday that its A$733 million ($477.8 million) offer to buy Australia’s ...

Toronto-listed miner OceanaGold Corp said on Wednesday it will raise 6.08 billion pesos ($106 million) through an ...

Gold’s record-setting rally this year has puzzled market watchers as bullion has roared higher despite headwinds that ...

AbraSilver Resource said on Monday it has received investments from both Kinross Gold and Central Puerto, Argentina’s ...

Gold took a tumble as haven demand waned after geopolitical tensions eased in the Middle East.

The four largest indigenous communities in Chile’s Atacama salt flat suspended dialogue with state-run copper giant ...

A prefeasibility study for Predictive Discovery’s (ASX: PDI) Bankan gold project in Guinea gives it a net present value ...

Representatives from the Peñas Negras Indigenous community, in northwestern Argentina, clashed with heavily armed police ...

Newmont confirmed on Wednesday that two members of its workforce died this week at the Cerro Negro mine located in the ...

No comments have been posted yet ...