- Write by:

-

Friday, June 21, 2019 - 11:44:00 AM

-

1184 Visit

-

Print

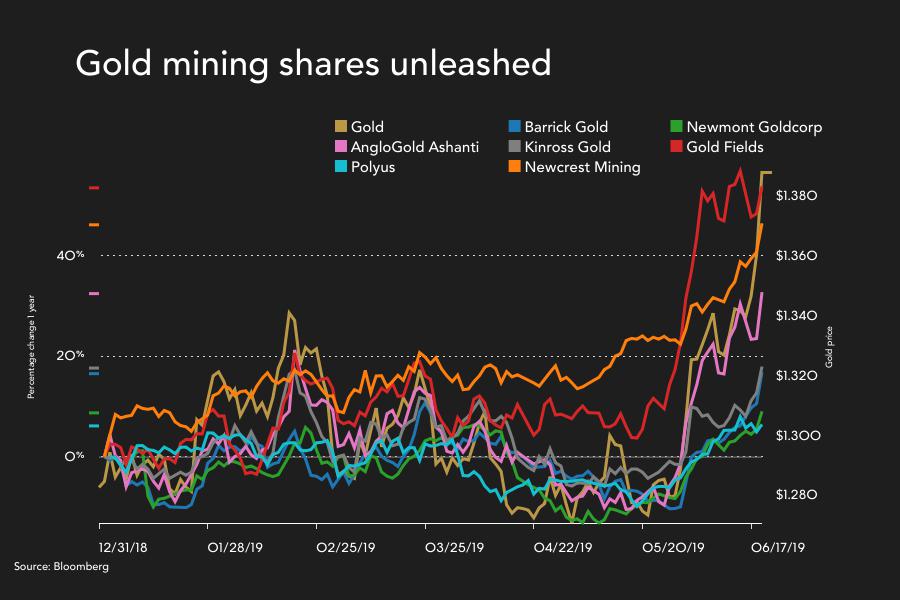

Mining News Pro - Gold gathered momentum on Thursday sending the shares of gold miners higher across the board.

According to Mining News Pro - Gold for delivery in August, the most active futures contract trading in New York, settled at $1,396.90 an ounce. That’s up nearly $50 an ounce or 3.6% from yesterday’s settlement and the highest since September, 2013.

Barrick Gold, until last year the world’s no 1 gold miner in terms of ounces produced, jumped 5.7% in more than three times usual volume of shares traded. Barrick is trading at the highest since October 2017 and is now worth $27 billion in New York.

Newmont Goldcorp ended the day 3.4% higher for a market value just short of $31 billion. Newmont absorbed Vancouver-based Goldcorp this year and the combined company is targeting output of 8.4m ounces this year, 2.8m ounces more than Barrick’s forecast production in 2019.

World number three gold producer AngloGold Ashanti which is estimating output of around 3.4m ounces this year surged nearly 7% on Thursday in New York where the Johannesburg-based company’s ADRs are listed. The company, worth $7 billion, is trading at a three-year high.

Toronto’s Kinross Gold, last year the world’s no 4 gold producer at over 2.4m ounces gained 4.6% lifting its market value to $4.8 billion. The performance of Russian producer Polyus was more subdued and units of the company trading in London added less than 1% to lift the company’s value to $11.5 billion. Moscow-based Polyus is set to overtake Kinross as the fourth largest gold producer.

Gains were even more spectacular further down the rankings with Canada’s Yamana Gold leading with a 9% advance for a market cap of $2.3 billion. Harmony Gold added 7.4% lifting its market worth to over a $1 billion. The South African firm last year produced 1.4m ounces of gold compared to 940,000 ounces for Yamana.

South Africa’s Gold Fields jumped 4% and the company’s depositary receipts are now valued at $4.4 billion in New York, a three-year high for the 2m ounce-plus gold miner.

Australia’s Newcrest Mining was set to add to its 4% gains on Thursday as markets open in the country for Friday’s session. Newcrest is worth $17.5 billion and last year mined 2.4m ounces, 6% more than than in 2018. Agnico Eagle, the world’s no 9 gold miner in terms of annual production, is worth $11.7 billion a 3% gain on Thursday.

Short Link:

https://www.miningnews.ir/En/News/388776

China’s Zhaojin Mining Industry said on Wednesday that its A$733 million ($477.8 million) offer to buy Australia’s ...

Toronto-listed miner OceanaGold Corp said on Wednesday it will raise 6.08 billion pesos ($106 million) through an ...

Gold’s record-setting rally this year has puzzled market watchers as bullion has roared higher despite headwinds that ...

AbraSilver Resource said on Monday it has received investments from both Kinross Gold and Central Puerto, Argentina’s ...

Gold took a tumble as haven demand waned after geopolitical tensions eased in the Middle East.

The four largest indigenous communities in Chile’s Atacama salt flat suspended dialogue with state-run copper giant ...

A prefeasibility study for Predictive Discovery’s (ASX: PDI) Bankan gold project in Guinea gives it a net present value ...

Representatives from the Peñas Negras Indigenous community, in northwestern Argentina, clashed with heavily armed police ...

Newmont confirmed on Wednesday that two members of its workforce died this week at the Cerro Negro mine located in the ...

No comments have been posted yet ...