- Write by:

-

Tuesday, August 25, 2020 - 10:23:36 PM

-

496 Visit

-

Print

Mining News Pro - Caldas Gold is looking to raise up to $90 million through a fully marketed private placement of subscription receipts.

Canadian junior miner announced it has settled terms for the proposed issuance and sale of 90,000 subscription receipts of the company at a price of $1,000 each, with Scotiabank and Canaccord Genuity acting as co-lead agents on behalf of a syndicate of agents including Stifel Nicolaus Canada and Red Cloud Securities.

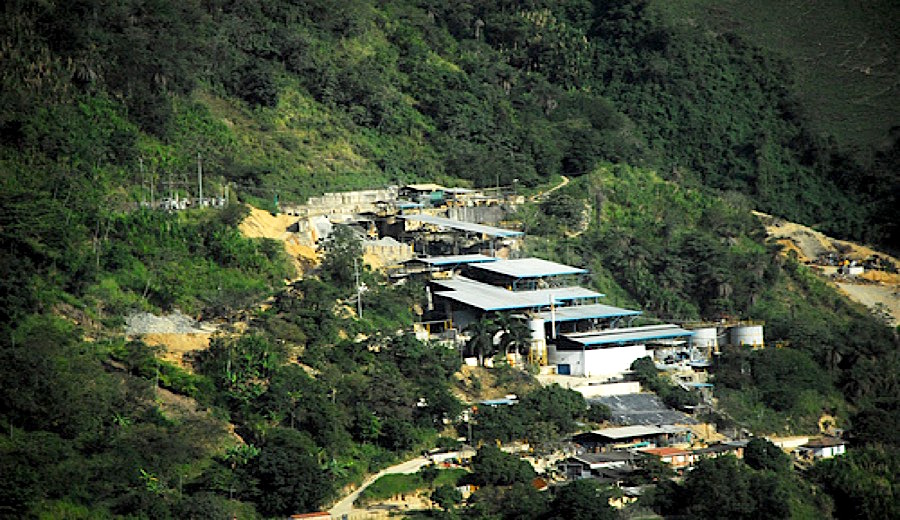

The company anticipates raising $80 million to $90 million from the offering, said Chairman and CEO Serafino Iacono. Proceeds will be used to fund the expansion of Caldas’ mining operations at the Marmato project in Colombia.

The Marmato project comprises two distinct operations — the existing Upper Zone operation and a new Deeps Zone operation that sits directly below the Upper Zone vein system. Last year, the Upper Zone mine produced 25,750 ounces of gold.

Earlier this year, Caldas entered a $110 million streaming deal with Wheaton Precious Metals (NYSE: WPM) to develop the Deep Zone mineralization. This was followed up by a special warrant financing of C$45 million to secure additional funding for the expansion project.

Located within a historical mining district, the project contains an estimated 2 million ounces of gold resources in the measured and indicated categories and 3.3 million ounces of gold resources in the inferred category.

A prefeasibility study (PFS) incorporating the new mine is currently underway and is expected for completion mid-2020.

Shares of Caldas Gold surged 6% on news of the latest financing. The company has a market capitalization of approximately C$193.7 million.

Short Link:

https://www.miningnews.ir/En/News/590150

Chinese carmaker BYD Co has postponed plans to produce lithium cathodes for electric vehicle (EV) batteries in Chile by ...

Copper futures in New York rallied to a record high after a short squeeze that’s prompted a scramble to divert metal in ...

China’s CMOC Group Ltd. is being accused by a top US official of using “predatory” tactics to depress prices of a key ...

A Native American group said on Tuesday it will take its fight against Rio Tinto’s proposed Arizona copper mine to the ...

Teck Resources Ltd expects to generate annual earnings before interest, depreciation, tax and amortization (EBITDA) of ...

The world’s largest zinc smelter is planning to significantly expand its copper output, taking advantage of growth ...

The state-run Chilean Copper Commission (Cochilco) will soon revise its copper price outlook, which will be considerably ...

Chilean mining giant Codelco is still working to meet its estimated output for the second quarter, CEO Ruben Alvarado ...

Australian-based Atlantic Lithium Ltd., which is developing Ghana’s first lithium mine, has taken a step toward raising ...

No comments have been posted yet ...