- Write by:

-

Monday, August 28, 2017 - 2:24:30 PM

-

1120 Visit

-

Print

Madan News Agency - Africa-focused Gem Diamonds (LON:GEMD) said Thursday it has received an acquisition offer for its Ghaghoo mine in Botswana, which it discontinued earlier in the year due to a decline in prices.

Madan News Reports; Announcing its half-year results, the company also said its revenue fell to $93 million for the six months to June 30, from $109 million a year earlier, due to a drop in output and diamond prices.

The average price per carat fell to $1,779 for the period, from $1,899 in the same period last year, while carats recovered fell 12 percent to 50,478, the company said.

Gem Diamonds, which also operates Letšeng in Lesotho, its flagship mine, produced 50,478 carats in the six months to June 30, compared with 57,380 carats in the same period last year.

“The updated life-of-mine plan [at Letšeng] was implemented during the period, with the objective of reducing waste tonnes mined and improving near-term cash flows, and mining progressed well against this plan during the period,” the company reported.

The miner said it remains cautious about the state of the global market for both rough and polished diamonds, noting that financing challenges persist and that the volatile macro-economic environment continues to create challenges for the middle diamond market.

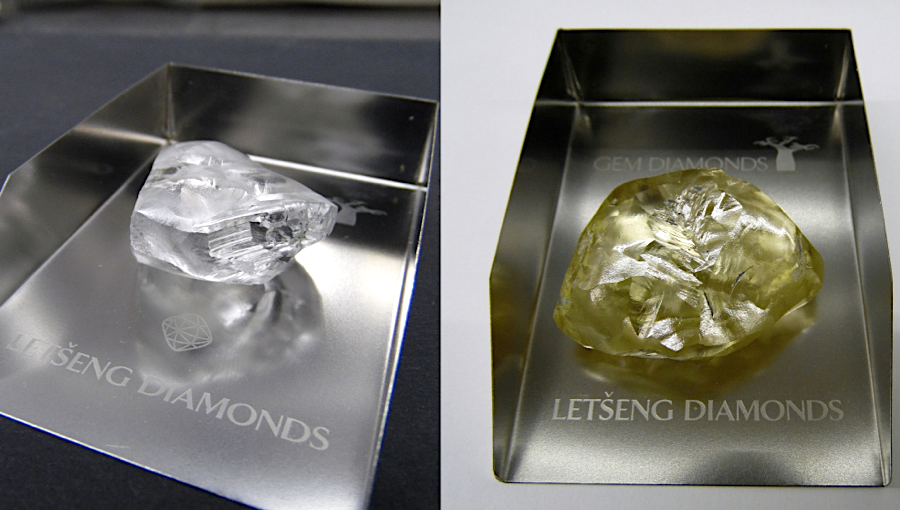

Since acquiring Letšeng in 2006, Gem Diamonds has found four of the 20 largest white gem quality diamonds ever recovered, which makes of the mine the world’s highest dollar per carat kimberlite diamond operation.

At an average elevation of 3,100 metres (10,000 feet) above sea level, Letšeng is also one of the world’s highest diamond mines.

Gem Diamonds placed Ghaghoo on care and maintenance in February this year, with the intention of resuming operations once market conditions improved. While the company didn’t reveal who is interested in acquiring the mine, it said the board was considering the offer.

Short Link:

https://www.miningnews.ir/En/News/23510

No comments have been posted yet ...