- Write by:

-

Wednesday, November 9, 2022 - 10:20:22

-

295 Visit

-

Print

Mining News Pro - The company said the West Dome Stage 8 cutback should start producing ore in the current quarter — its second quarter of fiscal year 2023 — and extend Telfer’a operations into early fiscal year 2025.

According to Mining News Pro - Newcrest Mining (ASX, TSX: NCM), Australia’s largest gold producer, has approved a A$214 million (about $140m) expansion of its Telfer gold-copper operations, which include the Main Dome, West Dome open pits and underground mines.

The company said the West Dome Stage 8 cutback should start producing ore in the current quarter — its second quarter of fiscal year 2023 — and extend Telfer’a operations into early fiscal year 2025.

The project, located in the metals-rich Paterson province of Western Australia, is nearby the company’s Havieron gold-copper asset, which it is advancing in a 70:30 partnership with Greatland Gold (LON: GGP).

The company, which is also the world’s no. 3 gold producer by market value, delayed in October the feasibility study for the project, which was due by the end of the December quarter.

While Newcrest has not provided a new timeline, it said extending the life of Telfer into 2025 will grant it more time to evaluate the Havieron satellite deposit.

“Telfer is strategically positioned in the highly prospective Paterson province and we are continuing to progress several potential options to expand the resource base in the open pits and underground to unlock additional value,” CEO Sandeep Biswas said in the statement.

Telfer produced 408,000 ounces of gold and 14,000 tonnes of copper in fiscal year 2022 at all-in sustaining costs of $1,388 an ounce.

The Melbourne-based firm expects to churn out between 355,000 and 405,000 gold ounces, as well as 20,000 tonnes of copper at the operation in fiscal year 2023.

Newcrest has been aggressively searching for juniors with appealing assets to jointly develop.

In 2019, the mining giant acquired a 70% stake in Canada’s Red Chris copper and gold mine from Imperial Metals (TSX: III).

Last year, it bought all outstanding common shares of Pretium Resources it did not already own in a deal that valued the Canadian miner at $2.8 billion.

Short Link:

https://www.miningnews.ir/En/News/622323

Iron ore futures prices drifted higher on Thursday as the latest soft data from top consumer China triggered renewed ...

Peru’s Las Bambas copper mine, owned by China’s MMG, is facing renewed blockades of a key transport route after failed ...

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with ...

Newmont confirmed on Wednesday that two members of its workforce died this week at the Cerro Negro mine located in the ...

Rio Tinto said on Wednesday it is teaming up with a global venture studio and start-up investor to back the development ...

Chinese investors are snapping up stocks tied to high-flying metals from copper to gold, aiding an onshore market facing ...

Outflows from global physically backed gold exchange traded funds (ETFs) continued for a 10th month in March, but at a ...

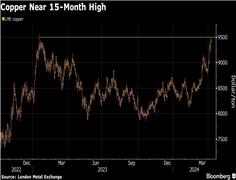

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Copper jumped to its highest intraday price since January 2023 as the bellwether industrial metal faces rising tighter ...

No comments have been posted yet ...