- Write by:

-

Sunday, September 18, 2022 - 11:36:20

-

698 Visit

-

Print

Mining News Pro - Europe’s power crisis, production cuts, and shortages of aluminum have left consumers in a quandary about Russian supplies of the metal vital for the region’s transport, construction and packaging industries.

According to Mining News Pro - Some are choosing to shun Rusal’s metal, while others are more sanguine – pointing to the fact that neither the company nor its metal is under sanctions imposed on other Russian companies after Moscow’s invasion of Ukraine in February.

Sign Up for the Africa, Europe & Middle East Digest

Known in the industry as “the mating season”, consumers and producers gathered at a conference in Barcelona this week to agree on deals to buy and sell aluminum for next year.

Organizers declined to accredit Rusal’s team for the event, without giving a clear reason, two sources familiar with the matter told Reuters. Rusal’s team came to the city anyway, one of them added.

“Some people don’t want Rusal’s aluminum on moral grounds, because of the war in Ukraine,” an aluminum trader in Barcelona told Reuters.

“Others are not worried because Rusal is still sanction-free, though they are milking it, asking for discounts.”

Major consumer Constellium is one company that expects to keep buying Hong Kong-listed Rusal’s aluminum.

Among those rejecting Russian metal for next year are one of the world’s largest aluminum consumer, Novelis, a division of Hindalco Industries, and a unit of Norsk Hydro supplying aluminum products to the auto and construction industries.

Some small companies in Europe, including Germany, decided not to sign up for Rusal’s metal for next year, a trader told Reuters.

Some medium size companies have also decided to stop buying Russian aluminum from next year, Duncan Hobbs, an analyst for Concord Resources, told Reuters, without elaborating.

“We have hundreds of clients globally, representing one of the strongest and most diverse customer bases in the industry. Our business is not defined by those few who choose to buy their aluminum elsewhere,” a Rusal representative told Reuters.

For some European consumers facing record high electricity prices, squeezed margins, and regional shortages, a discount for Rusal’s metal is attractive. There is currently a $100-$150 per tonne discount for Russian aluminum, a trader said.

Europe’s aluminum output capacity is about 4.5 million tonnes. Of that, more than 1.1 million tonnes have been taken offline since 2021 and another 500,000 tonnes is under threat, Citi analysts say.

Companies with contracts for this year agreed in 2021, have continued to buy aluminum from Rusal, the world’s largest producer outside China, accounting for 6% of global supplies estimated at around 70 million tonnes this year.

“There is a feeling that Russia wants to sell more aluminum than before,” a European consumer told Reuters in Barcelona, adding that Rusal, fearing sanctions, could be seeking cash flow.

Short Link:

https://www.miningnews.ir/En/News/622195

Iron ore futures prices drifted higher on Thursday as the latest soft data from top consumer China triggered renewed ...

Peru’s Las Bambas copper mine, owned by China’s MMG, is facing renewed blockades of a key transport route after failed ...

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with ...

Newmont confirmed on Wednesday that two members of its workforce died this week at the Cerro Negro mine located in the ...

Rio Tinto said on Wednesday it is teaming up with a global venture studio and start-up investor to back the development ...

Chinese investors are snapping up stocks tied to high-flying metals from copper to gold, aiding an onshore market facing ...

Outflows from global physically backed gold exchange traded funds (ETFs) continued for a 10th month in March, but at a ...

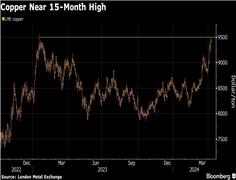

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Copper jumped to its highest intraday price since January 2023 as the bellwether industrial metal faces rising tighter ...

No comments have been posted yet ...