- Write by:

-

Tuesday, April 12, 2022 - 13:07:09

-

637 Visit

-

Print

Mining News Pro - Glencore Plc traded above its IPO price for the first time since 2011 as Russia’s invasion of Ukraine continues to drive up commodity prices.

The shares breached 530 pence in London on Monday after surging 42% this year. It’s a level Glencore, the world’s biggest commodities trader, had at times looked unlikely to ever regain.

Nearly all the company’s most important commodities are trading at or near record levels. Markets from metals to oil and gas have been upended by the war in Ukraine as big corporates withdraw from Russia, lenders pull back from financing deals and the threat of new sanctions deters buyers. The Bloomberg Commodity Spot Index has surged 26% this year.

The milestone also caps a strong 12 months for Glencore itself. The company in February reported record earnings, announcing $4 billion in dividends and buybacks. The trading house said it expects to resolve long-running corruption probes by U.S., U.K. and Brazilian authorities this year.

Glencore first sold shares in 2011 at the height of the last commodity super cycle, and hit an all-time high of 547.2 pence soon after. Since then, its stock has remained well below those levels, trading as low as 66.67 pence during the 2015 commodity crash. Glencore traded at 533.20 pence by 10:10 a.m. in London.

For years, Glencore’s shares also underperformed many of its biggest rivals, as the company missed out on rising prices for iron ore — which it doesn’t produce — and investors were deterred by sprawling anti-corruption investigations.

However, the commodities giant has positioned itself to be one of the biggest winners from what some analysts see as a new commodity supercycle, with a sprawling suite of mines producing many of the materials needed for the green energy transition. As the world’s biggest coal shipper, the company is also benefiting from the global energy crunch.

The shares dipped briefly in mid-March, when Qatar’s sovereign wealth fund sold part of its large stake in the company at a discount to the market price. The sale of about 13% of its holding left BlackRock Inc. and former Chief Executive Officer Ivan Glasenberg as Glencore’s top investors.

Glencore is not the only miner to rally — Anglo American Plc is trading at its highest-ever level and most other raw-materials producers have surged this year.

Short Link:

https://www.miningnews.ir/En/News/621046

A Native American group has asked all members of a US appeals court on Monday to overturn an earlier ruling that granted ...

Codelco is exploring more partnerships with the private sector as Chile’s state copper behemoth looks to recover from a ...

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

Peru’s Las Bambas copper mine, owned by China’s MMG, is facing renewed blockades of a key transport route after failed ...

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with ...

Chinese investors are snapping up stocks tied to high-flying metals from copper to gold, aiding an onshore market facing ...

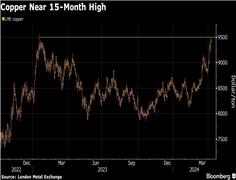

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Copper jumped to its highest intraday price since January 2023 as the bellwether industrial metal faces rising tighter ...

Mining News Pro - Amir Khormishad, the CEO of the National Copper Industries Company of Iran, announced the 49% growth ...

No comments have been posted yet ...