- Write by:

-

Friday, August 20, 2021 - 14:30:44

-

666 Visit

-

Print

Mining News Pro - China is warily eyeing the resumption of some Afghan resource projects but it will take years before the infrastructure is ready while security issues threaten to once again stall projects, according to state media and industry sources.

Afghanistan's vast mineral wealth - including large reserves of lithium, which is key to the burgeoning electric-vehicle sector - has been trumpeted as a path to economic independence for the country but instability has repeatedly hampered past projects, dousing most foreign investor interest.

"I wouldn't and couldn't invest in Afghanistan with the Taliban running the country. It's lawless," said Ben Cleary, the chief executive of Tribeca Investment Partners, which runs a global natural resources fund and finances mining projects.

He added that he couldn't see any companies listed in Australia, Canada or the United States having a mandate to buy assets there.

"China would be the only potential buyer."

China could contribute to post-war reconstruction in Afghanistan and resume major stalled projects, state-owned tabloid Global Times, said on Aug. 17, while noting security concerns.

A consortium of Metallurgical Corp of China (MCC) and Jiangxi Copper took on a 30-year lease for Afghanistan's largest copper project, the Mes Aynak mine, in 2008 but it remains undeveloped.

One MCC source told Reuters this week it could take five to six years to build infrastructure for mining at Mes Aynak but the project could not go anywhere while safety concerns linger.

Eight security force members were killed in a Taliban attack on a checkpoint at the mine last year.

"It is impossible to push forward the project without a safe environment," the source said.

MCC and Jiangxi Copper did not immediately respond to requests for comment.

The Global Times cited an unnamed MCC source as saying the company would consider reopening the mine once the situation is stabilised, and international recognition of the Taliban regime, including by the Chinese government, takes place.

CHINA, TALIBAN MEETING

There has been no official recognition, although China's State Councillor and Foreign Minister Wang Yi hosted Mullah Baradar, chief of the Taliban's political office, in Tianjin last month and said the Taliban is expected to play an important role in Afghanistan's peace and reconstruction process.

China's foreign ministry did not immediately respond to a request for comment on whether it already had raised the issue of developing Afghanistan's resources with the Taliban.

These resources also include gold, natural gas, uranium, bauxite, coal, iron ore and rare earths but concerns about potential human rights abuses under a Taliban regime will likely prevent investment.

"I think most of the world's financial system is applying some fairly stringent ESG (environment social and governance) lenses now over investments in that sector," said ANZ Senior Commodity Strategist Daniel Hynes in Sydney. "It would be a pretty difficult project to get underway considering all the hurdles."

At least one Chinese project and one Indian project in Afghanistan will not be going forward.

State-owned China National Petroleum Corp (CNPC) is in the process of exiting its oil project in the Amu Darya Basin in northern Afghanistan, a company official told Reuters this week.

"It's not a big investment. CNPC sees the investment as a failure," said the official, without further elaboration.

The state energy major began producing oil there in 2012 under a 25-year contract but stopped work the following year as plans to refine the oil in Turkmenistan hit a snag.

The project, which could have been a key income source for the war-torn state, had also come under attack from local militants.

CNPC declined to comment.

A consortium of Indian companies led by Steel Authority of India (SAIL) were awarded rights to build a steel mill and develop iron-ore mines in Afghanistan with a total investment of $11-billion in 2011.

"SAIL's inroads into Afghanistan were purely a political commitment and they were promised a steel plant," an official at SAIL with direct knowledge of the matter told Reuters on Thursday.

The project had been shelved due to poor iron-ore quality, lack of security and a threat to employees safety, the official, who declined to be named, said.

SAIL and the Indian government did not immediately reply to requests for comment.

Afghanistan's Ministry of Mines and Petroleum did not immediately respond to a request for comment.

Short Link:

https://www.miningnews.ir/En/News/615365

A prefeasibility study for Predictive Discovery’s (ASX: PDI) Bankan gold project in Guinea gives it a net present value ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

Iron ore futures prices drifted higher on Thursday as the latest soft data from top consumer China triggered renewed ...

Rio Tinto said on Wednesday it is teaming up with a global venture studio and start-up investor to back the development ...

Outflows from global physically backed gold exchange traded funds (ETFs) continued for a 10th month in March, but at a ...

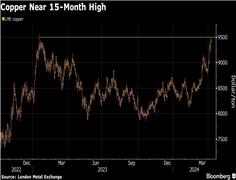

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Australia’s Fortescue said on Monday it would form a joint venture with OCP Group to supply green hydrogen, ammonia and ...

No comments have been posted yet ...