- Write by:

-

Saturday, March 27, 2021 - 1:30:12 PM

-

1009 Visit

-

Print

Mining News Pro - Nova Resources, the consortium bidding to take copper miner KAZ Minerals private has increased its offer by 9% to £4.02B ($5.5 billion), after minority shareholders said they would reject earlier proposals for being too low.

Nova, which is controlled by KAZ chair Oleg Novachuk and billionaire Vladimir Kim, said it would pay 850 pence per share plus a special dividend, which lifts the total bid to 869p/share for the 61% of the mining company it doesn’t already own.

The fresh and final offer is up from a previous bid of 780p per share made in February and a first attempt made in October proposing 640p per share.

Commenting on the improved bid, Novachuk said Nova had listened to shareholders unhappy with the previous offers.

Copper is in high demand for use in renewable energy and electric vehicles, but new deposits are rare and increasingly difficult to recover.

“Copper market dynamics have evolved since the announcement of the original offer in October 2020, and the final increased offer fully reflects this change,” Novachuk added.

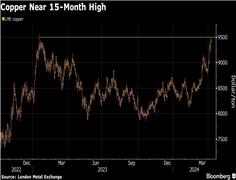

Prices for the metal have shot up in the last six months, rising to a 10-year high of almost $9,500 a tonne before easing to about $8,680 on Thursday.

Click here for an interactive chart of copper prices

Analysts at Peel Hunt were not impressed by Nova’s increase, but wrote it would “probably mute the pressure for a further increase” from investors.

“This increase feels similar to the last (the increase to 780p from 640p), in that it moves the offer to roughly where the share price is (840p as of Thursday’s close), rather than providing a knockout blow,” the experts wrote.

World’s top copper prospect

KAZ Minerals bought the Baimskaya copper mine in eastern Russia in 2018 from a group of investors including Chelsea soccer club owner Roman Abramovich.

The company’s stock dived after announcing the acquisition, hit by investor concern over Russian political risk, even though the mine is regarded as one of the world’s most significant underdeveloped copper prospects.

Costs of developing the mine are estimated at almost $8 billion and Nova noted on Friday that among the project’s risks there are potential cost blowouts, increased working capital requirements and liabilities related to long-term logistics contracts.

“In this context, Kaz Minerals’ long-term interests are best served as a private organisation,” Novachuk said.

Shares in Kaz Minerals were up almost 3% to 864p in London on Friday by 1pm local time, leaving the company with a market capitalization of £4.1 billion.

Short Link:

https://www.miningnews.ir/En/News/611935

A Native American group has asked all members of a US appeals court on Monday to overturn an earlier ruling that granted ...

Codelco is exploring more partnerships with the private sector as Chile’s state copper behemoth looks to recover from a ...

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

Peru’s Las Bambas copper mine, owned by China’s MMG, is facing renewed blockades of a key transport route after failed ...

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with ...

Chinese investors are snapping up stocks tied to high-flying metals from copper to gold, aiding an onshore market facing ...

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Copper jumped to its highest intraday price since January 2023 as the bellwether industrial metal faces rising tighter ...

Mining News Pro - Amir Khormishad, the CEO of the National Copper Industries Company of Iran, announced the 49% growth ...

No comments have been posted yet ...