- Write by:

-

Friday, February 12, 2021 - 1:07:12 PM

-

778 Visit

-

Print

Mining News Pro - Australian miners are making moves on rare earths projects as the commodity gains momentum driven by demand from the electric vehicle (EV) market.

Sunshine Gold has agreed to acquire the Ravenswood West gold-copper-rare earths project from Stavely Minerals, while Hastings Technology Metals advances the Yangibana project, both of which are in Western Australia.

The Ravenswood West project hosts not only prospective intrusion related gold and porphyry copper but also rare earth elements including molybdenum, covering a 20-25 kilometre fault strike.

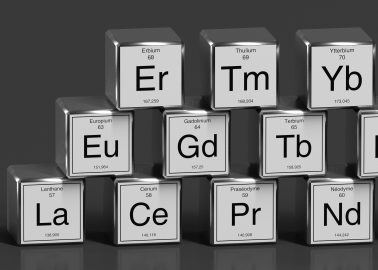

This includes high-grade gold results with assays of 0.19 grams per tonne of gold, 0.31 per cent neodymium, 0.43 per cent lanthanum, 0.91 per cent cerium, 926 parts per million praseodymium and 514 parts per million samarium.

Neodymium, lanthanum, cerium and praseodymium were ranked at third, fifth, sixth and seventh in the United States Geological Survey order of criticality, respectively.

Despite its promise, Ravenswood West has had little exploration attention in the past.

“Ravenswood West ticks all of our acquisition drivers, near surface, big system potential, underexplored and close to infrastructure and mining hub workforces,” Sunshine managing director Damien Keys said.

Last year, Hastings gained process plant work permits for the Yangibana project and discovered that the project boasted the highest value rare earths project for ore value per kilogram in the world.

This is 75-175 per cent higher value than any current producing rare earth project, with 92 per cent of ore value contained in the four key elements (dysprosium, terbium, praseodymium and neodymium) required for the EV market.

One Australian miner that has already had a taste of the hunger emerging industries have for rare earths is Australian Strategic Metals (ASM).

ASM has turned the high-purity neodymium-iron-boron from its New South Wales’ Dubbo project into pre-sintered permanent magnets by the Korean Institute of Rare Metals (KIRAM).

KIRAM’s testing has indicated ASM’s neodymium-iron-boron product is suitable for producing the magnets in commercial demand, validating the company’s strategy to become a mine to manufacturer rare earths producer.

“The excellent support and collaborative work delivered a truly significant result,” ASM managing director David Woodall said.

“It provides ASM with confidence that our integrated business model, from the Dubbo project to metals production can play an important part in the Korean Government’s new green deal.

“We now have confirmation of the quality and high purity of the permanent magnet alloy and titanium powders ASM can deliver.”

This allows ASM to be fully operational at Dubbo by mid-2022.

Short Link:

https://www.miningnews.ir/En/News/610451

Australian miner Lynas posted a slump in third-quarter sales revenue on Wednesday, missing analyst expectations on the ...

Gold’s record-setting rally this year has puzzled market watchers as bullion has roared higher despite headwinds that ...

AbraSilver Resource said on Monday it has received investments from both Kinross Gold and Central Puerto, Argentina’s ...

Gold took a tumble as haven demand waned after geopolitical tensions eased in the Middle East.

The four largest indigenous communities in Chile’s Atacama salt flat suspended dialogue with state-run copper giant ...

A prefeasibility study for Predictive Discovery’s (ASX: PDI) Bankan gold project in Guinea gives it a net present value ...

Representatives from the Peñas Negras Indigenous community, in northwestern Argentina, clashed with heavily armed police ...

Newmont confirmed on Wednesday that two members of its workforce died this week at the Cerro Negro mine located in the ...

Chinese investors are snapping up stocks tied to high-flying metals from copper to gold, aiding an onshore market facing ...

No comments have been posted yet ...