- Write by:

-

Monday, July 9, 2018 - 1:56:06 PM

-

1186 Visit

-

Print

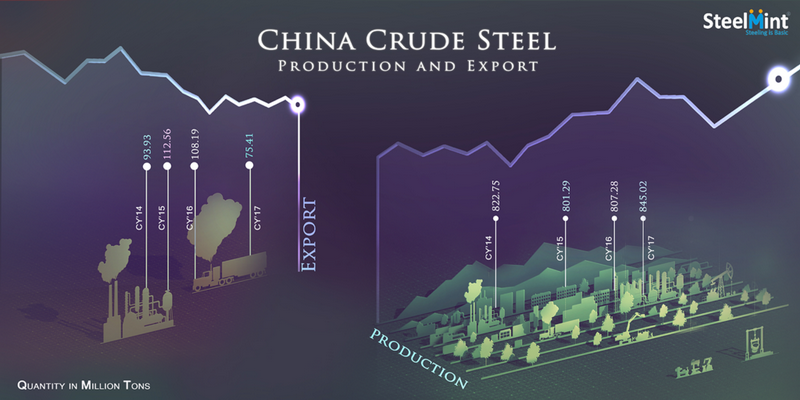

Mining News Pro - The global steel trade is very competitive. In May`18, China exported 6.883 MnT of steel, down 1.4% Y-o-Y. From January to May, China exported 28.493 MnT of steel, down 16.3% Y-o-Y. While the volume of China`s steel exports slip, it has continued to explore the Southeast Asian market with huge consumption potential, hoping to offset the gap brought about by the export of Western markets. Indonesia and Malaysia may account for Chinese steel exports.

According to a report on June 24,

in the past four years, Chinese steel companies have invested in a new steel

project with an annual output of 32 MnT in Indonesia and Malaysia, which is

equivalent to more than 40% of the steel consumption of the 10 member countries

of the Association of Southeast Asian Nations in 2016.

China`s plan on reduction of domestic

capacity is steadily underway, and it will be a good alternative to export

steel products to Southeast Asian markets given that the export to the United

States is limited. In Indonesia, China Qingshan Holding Group has invested in

the expansion of low-quality nickel smelting facilities with an annual output

of 1.5 MnT. In Malaysia, Hebei Dongshan Group and China Metallurgical Overseas

Engineering Co., Ltd. are cooperating to build a coking coal and cement plant

next to a new USD 3 billion steel plant.

If China`s steel industry wants to maintain

steady exports and offset the impact of the US market, it is necessary to grasp

the entire Southeast Asian market. As the continuous adjustment of the global

industrial chain, the economical human resources in Southeast Asia have

attracted a large amount of investment, which has led to the rapid development

of manufacturing and processing industries in the region, driving the demand

for steel to grow. The demand for steel in the 10 ASEAN countries in 2017 is as

high as 70 MnT and it is expected to grow to 80 MnT in 2018.

According to the World Steel Association

statistics, Thailand imported 12.6 MnT of steel in 2017, becoming the world`s

second largest net importer of steel after the United States while Vietnam`s

net import of steel is 12.3 MnT, ranking third in the world; If add up the

Philippines and Malaysia markets,the net import of steel in the above five

Southeast Asian countries reached 46.9 MnT in 2017. This is a reflection of the

imbalance of steel supply and demand in the Southeast Asia region.

However, China`s export of steel products

to Southeast Asia is not always smooth. The cheap steel from China will first

compete directly with local steel companies in Southeast Asia and will also

face the impact of traditional Japanese and Korean exporters. But one thing can

benefit is China’s experience in technology, production, planning and

construction in the steel industry as a “sought after resource” in the

Southeast Asian steel market. We can take the advantage of “Chinese experience”

as an add-on to compete with the Southeast Asian market and form complementary

relation with local markets to realise increased steel exports.

Short Link:

https://www.miningnews.ir/En/News/210135

Mining News Pro - This week Chinese steel prices exhibited optimistic market sentiments with improvement in steel prices ...

Mining News Pro - China`s steel and iron ore markets are currently crowded with an overload of information, much of it ...

Mining News Pro - Japanese based major steelmaker Tokyo Steel likely to increase plate prices for the first time in 11 ...

Mining News Pro - This week Chinese steel market was consumed with mixed sentiments as nation witnessed drop in flat ...

Mining News Pro - China’s Jiangsu province has pledged to take tougher measures to tackle air pollution over next three ...

Mining News Pro - Tokyo Steel Manufacturing Co Ltd - Japan’s top electric-arc furnace steelmaker has kept steel prices ...

Mining News Pro - On uncertainties about hike in electricity power tariffs market turns stagnant.

Mining News Pro - Indian Iron & Steel prices remain on down trend during the week-41 (8th-13th Oct`18) on slack demand. ...

Mining News Pro - On Thursday, Canada unveiled new quotas and tariffs on imports of seven categories of steel from ...

No comments have been posted yet ...