- Write by:

-

Friday, September 25, 2020 - 6:38:33 PM

-

393 Visit

-

Print

Mining News Pro - Tin prices are due to extend their rally next year as top consumer China stocks up on the metal due to a recovery in demand for electronic goods.

The bulk of tin, making up nearly half of demand, goes into solder, used chiefly in the electronics industry to connect components.

The benchmark price of tin on the London Metal Exchange CMSN3 slid to $12,700 a tonne in March, the lowest level in more than a decade, as the coronavirus hit demand, but it had rebounded by 45% by early September largely due to recovery in China.

It has since slipped to around $17,500, weighed down along with other metals and stock markets by rising covid-19 cases, but analysts expect more gains late this year or early in 2021.

“As a result of this resurging demand, the tin market is set to remain in deficit until at least 2023. And as a result of this sustained deficit in our base case scenario, prices are set to return to about $20,000 a tonne in the short term,” Roskill analyst Adam Slade told a webinar this week.

Demand was hit by the pandemic as factories closed but supply also declined, with output from major miner PT Timah TINS.JK in Indonesia sliding 26% in the first half.

In recent months, the electronics sector has revived, with global semiconductor sales up 4.9% year-on-year in July.

Roskill forecasts world consumer electronics shipments will jump by 22% in 2021.

Strong demand, financial arbitrage and declining supplies have boosted Chinese refined tin imports, with tonnage during the first seven months of the year 11 times higher than the same period in 2019.

The Chinese buying along with rising demand elsewhere is due to send the market into deficit, Macquarie said in a note.

“We find enough reason here to adjust our supply/demand balance to account for some stocking this year and next. The resulting deficits look bullish for tin’s price in the next few years.”

Short Link:

https://www.miningnews.ir/En/News/605022

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

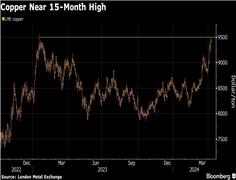

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Iron ore’s reset to around $100 a ton is indicative of a broader reshaping of China’s commodities markets that favors ...

Iron ore reversed direction after dropping to its lowest level in 10 months as optimism that the country’s economic ...

Copper rallied back above $9,000 a ton as investors weighed upbeat factory data from top consumer China and the ...

Shanghai copper prices were little changed on Friday, but poised for their biggest monthly gain in 16 months amid ...

Chinese smelters, which produce over half the world’s supply of refined copper, moved a step closer to implementing a ...

No comments have been posted yet ...