- Write by:

-

Friday, December 25, 2020 - 12:12:41 PM

-

459 Visit

-

Print

Mining News Pro - Gold prices steadied and most base metals were higher in holiday-thinned trading, with investors assessing the latest developments of a covid-19 relief package in the US and the final announcement of a post-Brexit trade deal.

Spot gold rose slightly by 0.3% to $1,879.40 per ounce by 12:40 p.m. EST, while US gold futures were up 0.2% to $1,882.70 per ounce.

On Thursday, the UK and European Union finalized their historic post-Brexit trade agreement, averting the threat of an acrimonious breakup.

Meanwhile, House Republicans blocked Democrats’ attempt to meet President Donald Trump’s demand to pay most Americans $2,000 to help weather the coronavirus pandemic. Democrats will try again with a roll call vote on a new bill next week.

“Gold prices are benefiting from a Brexit trade deal breakthrough that paved the way for a weaker dollar,” said Edward Moya, a senior market analyst at Oanda Corp.

Gold’s next move will depend on whether the fiscal stimulus situation in the US is resolved over the next week, said Jeffrey Halley, another senior market analyst at Oanda.

Investors are looking past Trump’s demand for changes to US pandemic relief, expecting that stimulus spending will come sooner or later.

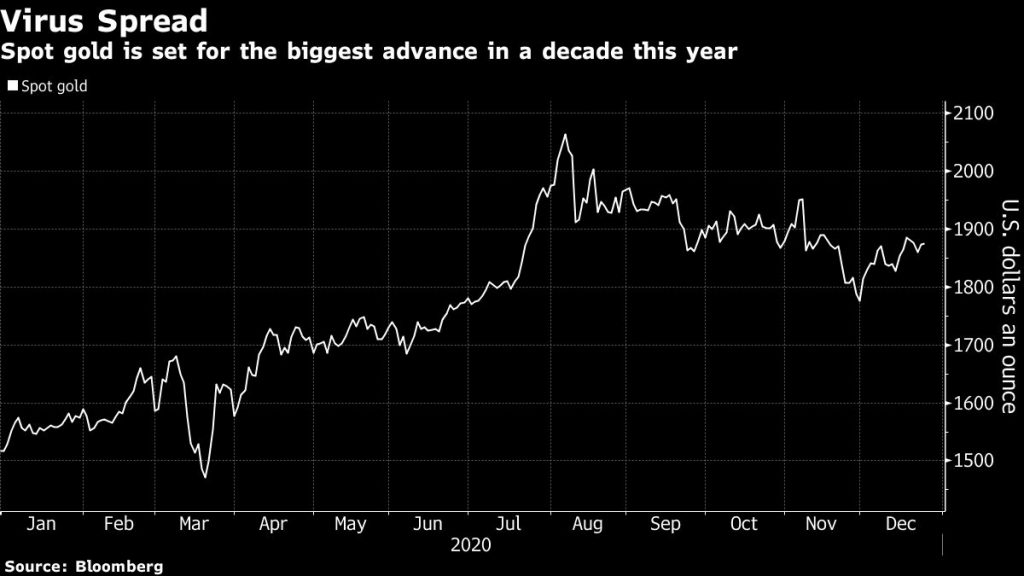

Bullion, largely considered a hedge against inflation, has risen about 25% so far this year amid the massive stimulus unleashed around the globe. This puts the precious metal on course for its biggest annual gain in a decade.

Short Link:

https://www.miningnews.ir/En/News/609853

The four largest indigenous communities in Chile’s Atacama salt flat suspended dialogue with state-run copper giant ...

A prefeasibility study for Predictive Discovery’s (ASX: PDI) Bankan gold project in Guinea gives it a net present value ...

Representatives from the Peñas Negras Indigenous community, in northwestern Argentina, clashed with heavily armed police ...

Newmont confirmed on Wednesday that two members of its workforce died this week at the Cerro Negro mine located in the ...

Chinese investors are snapping up stocks tied to high-flying metals from copper to gold, aiding an onshore market facing ...

Outflows from global physically backed gold exchange traded funds (ETFs) continued for a 10th month in March, but at a ...

i-80 Gold fell by over 11% at market open Tuesday following its announcement of a C$100 million ($74m) public offering ...

Australia’s Westgold Resources said on Monday it had agreed to acquire Toronto-listed Karora Resources in a ...

Chinese coal prices are likely to keep falling until the start of the peak summer season, suppressing imports of the ...

No comments have been posted yet ...