- Write by:

-

Friday, December 4, 2020 - 5:13:13 PM

-

1323 Visit

-

Print

Mining News Pro - Nickel Mines has successfully completed the institutional component of its A$364-million equity raising.

The company on Friday announced that the institutional entitlement offer raised some A$275-million, at 94c a share, and was well supported by institutional shareholders with a take-up of some 73%.

There was also demand from both existing and new institutional investors for the balance of the institutional component, comprising renounced entitlements and entitlements attributable to ineligible shareholders.

“We are delighted with the success of the offer which is a clear endorsement of the company’s achievements to date and the agreement to acquire a 70% interest in the Angel nickel project,” said Nickel Mines MD Justin Werner.

“This transaction is transformative for the company and is expected to approximately double the company’s nickel production capacity. It will provide us with operational footprints within what are estimated to become the world’s two largest nickel production centers and further cements and extends our excellent relationship with Shanghai Decent.”

Nickel Mines last week announced that it had reached an agreement with partner Shanghai Decent Investment to acquire a 70% interest in the Angel Nickel project for $490-million.

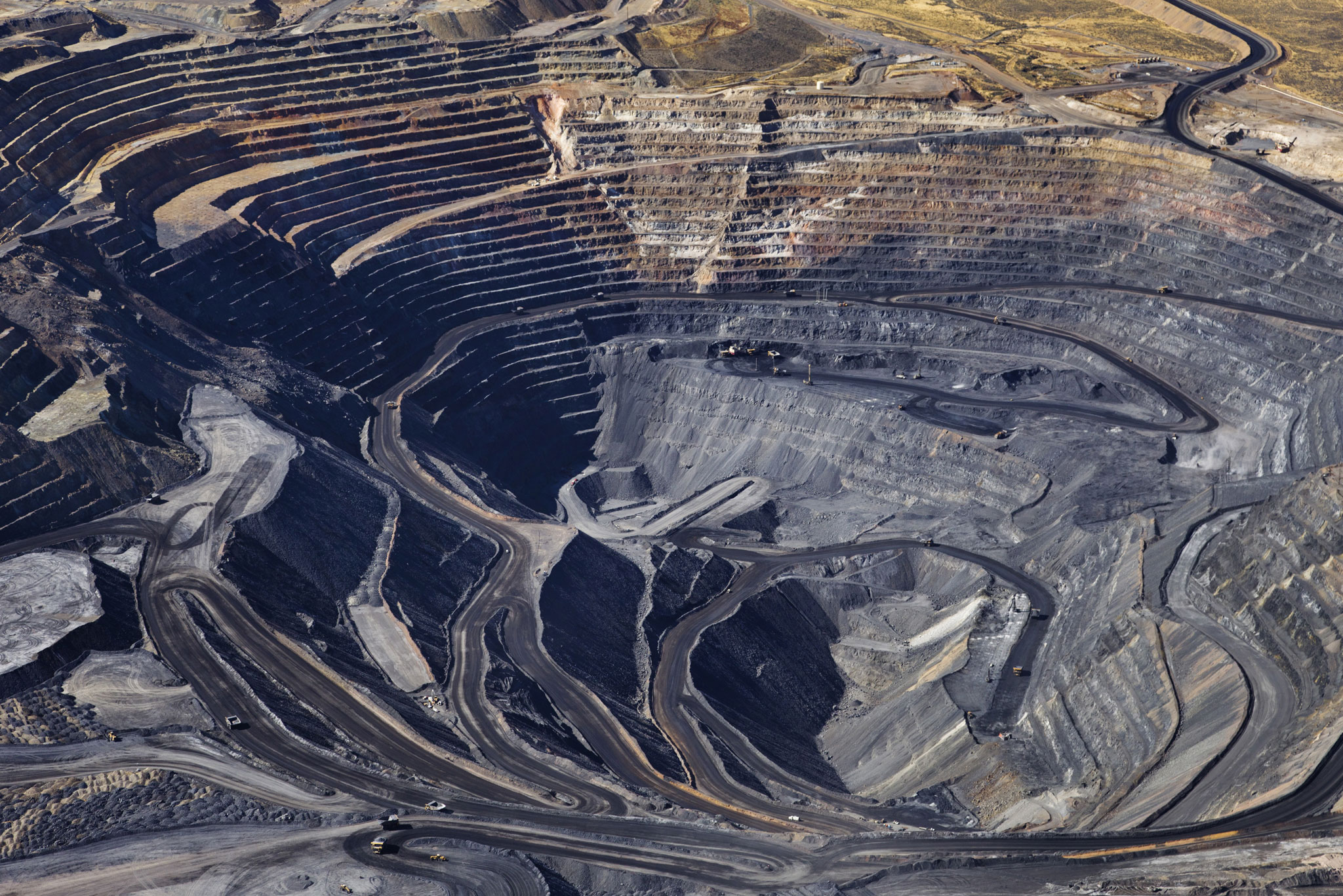

Angel will consist of four rotary kiln electric furnace (RKEF) lines, will have an annual nameplate capacity of 36 000 t of nickel metal and will include a 380 MW coal-fired power plant.

Meanwhile, the retail component of the entitlement offer will open on December 9, and is expected to raise a further A$89-million.

Short Link:

https://www.miningnews.ir/En/News/609614

Iron ore futures prices ticked lower on Monday, weighed down by diminishing hopes of more stimulus in top consumer ...

Interros, Nornickel’s largest shareholder, on Monday called allegations by fellow shareholder Rusal about undervalued ...

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

French mining group Eramet said on Wednesday it had reached an agreement with the French government to continue its ...

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Copper jumped to its highest intraday price since January 2023 as the bellwether industrial metal faces rising tighter ...

No comments have been posted yet ...