- Write by:

-

Tuesday, November 17, 2020 - 1:08:07 PM

-

808 Visit

-

Print

Mining News Pro - Zambia expects to conclude talks over buying Glencore Plc’s stake in Mopani copper mines Plc within a month, according to Barnaby Mulenga, permanent secretary in the Ministry of Mines.

Mulenga declined to disclose the size of the stake that state-owned ZCCM Investments Holdings is trying to acquire. ZCCM-IH currently has 10% of Mopani, with Glencore holding 73.1% and Vancouver-based First Quantum Minerals Ltd. 16.9%.

Zambia wants to raise its holding after clashing with Glencore earlier this year over the company’s plan to mothball Mopani’s operations. But it’s unclear how the cash-strapped government, which last week defaulted on a Eurobond interest payment, would finance a deal. While impairments of $1.14 billion at Mopani contributed to Glencore posting a first-half loss, the Switzerland-based commodity giant still assigned a value of $704 million to the operations.

Mulenga expects a deal to be announced in the coming weeks by Mines Minister Richard Musukwa, who said in September that both companies were prepared to sell their entire holding in Mopani. Zambia won’t have trouble raising finance for the deal, according to Mulenga, even though no money will come from the Treasury.

“The resource attracts money, so the issue of financing is the least of the worries for the Zambian government,” Mulenga said in an interview on Thursday, referring to Mopani’s copper-mining operations. He didn’t give further details.

A spokesman for Glencore declined to comment. First Quantum spokesman John Gladston also declined to comment.

Glencore shelved its plans to place the operations under care and maintenance for 90 days, after Zambia threatened to revoke its mining license in April. The government strategy is driven by a need to safeguard jobs at Mopani, rather than any desire to raise its shareholding, said Mulenga.

Zambia’s increasingly tense relations with investors in the key copper-mining industry may partly reflect maneuvering by President Edgar Lungu ahead of next year’s elections. The government is also in arbitration over mining assets it seized last year from billionaire Anil Agarwal’s Vedanta Resources Ltd.

Other copper miners have halted $2 billion of planned investments because of a dispute over a royalty tax. A mining conference later this year will seek to address that issue, Mulenga said.

“Hopefully we will come to some consensus to what should this tax regime look like,” he said.

Short Link:

https://www.miningnews.ir/En/News/608383

Copper traded near $10,000 a ton, hitting a new two-year high on its way, as investors continue to pile in on a bet that ...

A Native American group has asked all members of a US appeals court on Monday to overturn an earlier ruling that granted ...

Codelco is exploring more partnerships with the private sector as Chile’s state copper behemoth looks to recover from a ...

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

Peru’s Las Bambas copper mine, owned by China’s MMG, is facing renewed blockades of a key transport route after failed ...

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with ...

Chinese investors are snapping up stocks tied to high-flying metals from copper to gold, aiding an onshore market facing ...

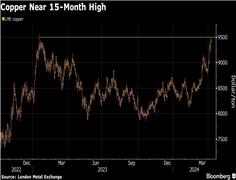

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Copper jumped to its highest intraday price since January 2023 as the bellwether industrial metal faces rising tighter ...

No comments have been posted yet ...