- Write by:

-

Monday, September 7, 2020 - 1:59:40 PM

-

680 Visit

-

Print

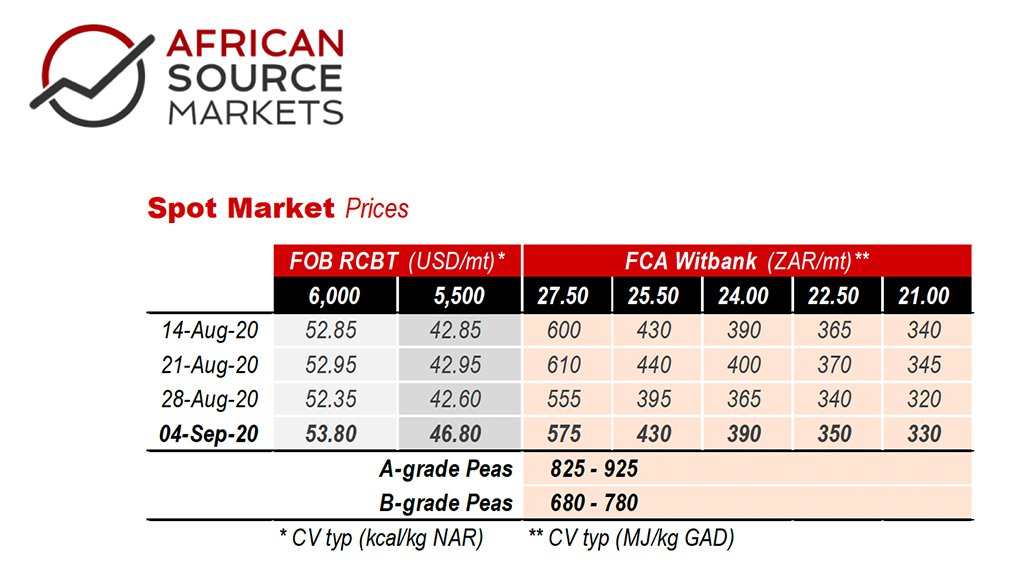

Mining News Pro - Price gains in European gas and power helped lift coal prices last week although China`s import restrictions have begun to impact on coal deliveries from Australia’s East coast. Australian cargoes are trading at significant discounts to paper prices, and NEWC itself is trading at several Dollars under RBCT.

For its part, Coal India still seeks to produce 1-bn tonnes by 2024 with auctions of coal blocks still scheduled for next month.

Colombian coal exports have meanwhile been trending down for the last couple of years, with recent strike action having helped lift price sentiment last week.

In China, large power utilities are actively pursuing a strategy of cross-subsiding renewable power development directly at coal power stations. This could be an interesting approach for Eskom to follow as well.

In more bizarre news, Zimbabwe has given the go-ahead for a Chinese consortium to explore for coal reserves in its top national game reserve – Hwange National Park. Recent droughts in the country have exerted more pressure on the need for coal power generation from the Hwange region.

South Africa continues with both load shedding and load reduction initiatives, although coal supplies remain healthy. The culture of non-performance and lack of accountability at Eskom was given a welcome shake-up as several senior coal plant executives were suspended.

It is almost as if the bottom Bollinger is pushing price upwards, as volatility keeps on reducing and standard

deviations, or market “stretchiness” subsides.

With the elastic Bollinger bands now tight again, it is becoming high time once more for further significant market moves.Unfortunately, with momentum having risen a fair bit since the lows of June, it could be that the next big move is down once more.

A concurrent move down in both MACD and a still negative signal line will be a significantly bearish trend

and could be quite nasty in the short term. This could lead to a wholesale shutdown of physical production amongst many export-dependent miners.

However, this will then of course build up large supply deficits in a recovering economy that is questioning the over-reliance on renewables, leading to an inevitable rally in coal prices to follow.

Short Link:

https://www.miningnews.ir/En/News/595825

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

The world’s coal-fired power capacity grew 2% last year, its highest annual increase since 2016, driven by new builds in ...

Peabody Energy Corp. shares sunk to the lowest in seven months after the biggest US coal miner warned that first-quarter ...

Polish government is abandoning plans to separate coal-fired power plants into a special company and is considering ...

Rio Tinto said on Wednesday it is teaming up with a global venture studio and start-up investor to back the development ...

BMO Bank quietly dropped its policy restricting lending to the coal industry in late 2023, helping it avoid being ...

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

No comments have been posted yet ...