- Write by:

-

Saturday, August 29, 2020 - 12:58:22 PM

-

944 Visit

-

Print

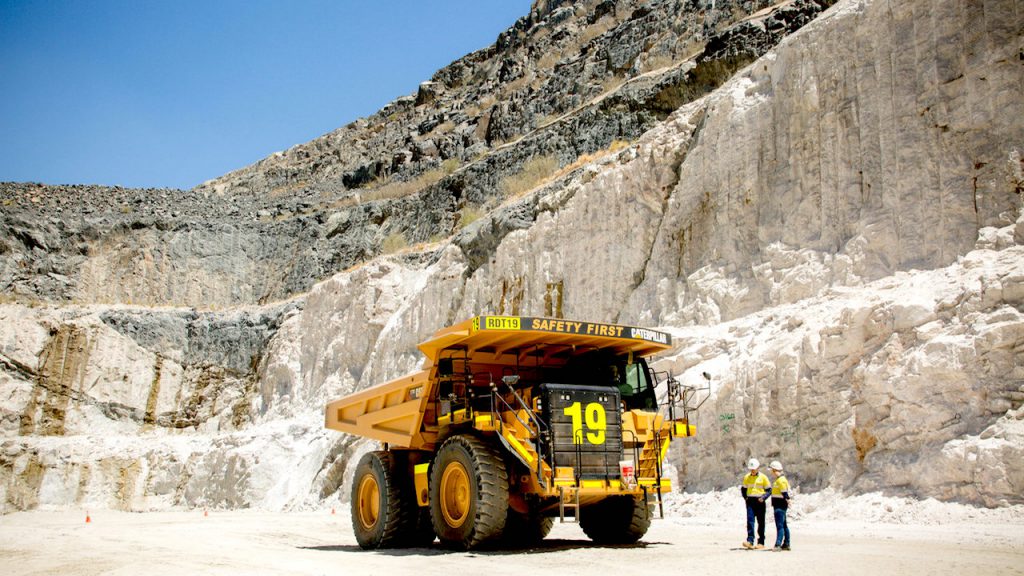

Mining News Pro - Hard rock miners have been hardest hit, with the price of spodumene concentrate (feedstock for lithium hydroxide manufacture) continuing to fall on the back of break-neck expansion in Australia, which quickly became the number one producer of lithium over South American brine producers.

Hard rock miners have been hardest hit, with the price of spodumene concentrate (feedstock for lithium hydroxide manufacture) continuing to fall on the back of break-neck expansion in Australia, which quickly became the number one producer of lithium over South American brine producers.

Roskill says, in a new industry outlook to 2030 report, this average is slightly misleading because Greenbushes, the largest and highest-grade mine of its kind, receives higher prices for its material owing to the integrated nature of the operation.

Excluding Greenbushes, the average spodumene import price into China was just $436 per tonne according to Roskill data, putting a full 50% of hard rock miners in a marginal to loss-making position on an all in sustaining cost basis during Q2:

Roskill is forecasting spodumene prices to remain subdued for the next 12-18 months – many producers look set to remain under pressure.

“Collectively, they face the dilemma of upping production (and utilisation rates) to generate the economies of scale needed to lower their cost base, while not exacerbating an already oversupplied market and deepening and/or prolonging the situation.”

Short Link:

https://www.miningnews.ir/En/News/591587

Chile’s state-run miner Codelco plans to select a partner for a future lithium project in one of the country’s top salt ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

Lithium supplier Vulcan Energy on Wednesday announced the start of production of the first lithium chloride at its ...

A stuttering recovery in lithium prices is providing a fresh reminder of why the dramatic rally of recent years was ...

A US and European Union push to reach an accord on fostering critical mineral supply chains is set to miss another ...

Trading of CME Group Inc.’s nearly three-year-old lithium hydroxide futures contract is soaring, with more funds ...

Chile’s mining production is starting to turn the corner after months of a sustained output slump, with the country’s ...

Undeterred by slumping profits, China’s lithium giants are planning to grab a bigger slice of the market.

Mitsui & Co said on Thursday it will spend $30 million to take a 12% stake in US-based Atlas Lithium to venture into ...

No comments have been posted yet ...