- Write by:

-

Friday, March 13, 2020 - 3:28:07 PM

-

963 Visit

-

Print

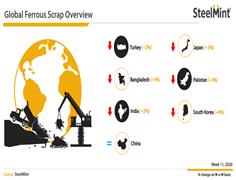

Mining News Pro - Imported Scrap offers to South Asia have been moved down considerably over the span of last one week, with the conclusion of several bulk cargoes to Bangladesh as well as Pakistan, pulling the tradable price level further low. Continuation of the severe container shortage has resulted in limited offers in containers from global suppliers, while high freight charges have made buyers cautious for fresh bookings.

According to Mining News Pro - Shredded scrap from USA/Europe currently stands at USD 310/MT CFR Chittagong. Shredded bookings to Bangladesh picked up last week after a rather slow Feb’20, with several shredded bookings in containers getting concluded at around USD 310-315/MT CFR Chittagong.

"A Chittagong based steelmaker recently booked 5,000 MT of containerized Shredded scrap in total from US and New Zealand origin at around USD 310-313/MT CFR."

Latest offers for Shredded scrap to Bangladesh have come down to USD 310/MT from US/Europe and USD 305 from Aus/NZ, while many buyers are targeting USD 300-305/MT levels for Shredded. Few offers of HMS 1 from Brazil were also reported at USD 290/MT. PnS offers stand range-bound at USD 305-310/MT depending on origins and delivery terms.

Recent hike in domestic steel prices is one of the main reasons for the resumption in container bookings by Bangladesh mills.

Bulk market to Bangladesh remained active, as after 3 bulk cargo bookings last week, 2 more USA origin Bulk vessels (32,000 MT mixed cargoes each) were contracted this week, at USD 290/MT and USD 283/MT CFR for Shredded, respectively by 2 mills in Chittagong. The 2nd booking at USD 283/MT CFR for Shredded seems to have come as distressed sale by one of the major USWC yards, at much below the prevailing market level. Additionally, several Japanese cargoes were booked at around USD 296-297/MT CFR for Busheling.

Pakistan – On one hand, Pakistan concluded its 2nd bulk Cargo in 2 weeks, as 7 steelmakers as a consortium, booked a 40,000 MT of Shredded cargo at USD 297/MT CFR Qasim earlier this week, while on the other hand container trades slowed down in spite of successive drop in offers last week.

Assessment for Shredded scrap in containers from UK/Europe stands at USD 300/MT CFR, while few bookings concluded at USD 301-302/MT CFR earlier in the week. Current offers from most UK yards range from USD 298-301/MT for Shredded, with few premium yards offering at up to USD 305/MT CFR. Meanwhile US suppliers are offering at a slightly lower level, with few offers of USD 296/MT also being reported.

HMS offers to Pakistan remain mostly stable this week, with HMS 1 super (no ci gi) being offered at around USD 295/MT CFR, with slight dip in interest from buyers.

Meanwhile, Pakistan’s domestic market stood stable this week, after a slight upturn in prices recorded last week. In the northern region, rebar’s average offer prices were reported at around PKR 106,000-107,000/MT, ex-works (USD 688-694), same as last week.

India - Indian imported scrap trades in containers continued to remain slow as buyers are learnt to have remained in `wait & watch` mode over sharp hike in rates of containers. Offers for Shredded scrap were heard at USD 300-305/MT, CFR Nhava Sheva which is lower by USD 3-4/MT W-o-W.

Also SteelMint learned that Port Health Organization (Govt of India) has issued a notification regarding cargo vessels clearing at JNPT which are coming from COVID-19 impacted countries like China, Thailand, Hong Kong, Singapore, Japan, South Korea, etc and the vessels will be screened and declared `suspect` or `healthy` by the govt.

Short Link:

https://www.miningnews.ir/En/News/501434

Mining News Pro - Due to falling exchange rates against Dollar in Southeast Asia and recession of the steel markets, ...

Mining News Pro - Global ferrous scrap market witnessed downward trend in prices for all major markets yet again.

Mining News Pro - This week, SE Asia billet import market was reported with mixed sentiments, as China’s billet ...

Mining News Pro - This week observed softening trends in major global scrap markets on weak demand.

Mining News Pro - This week observed softening trends in major global scrap markets. Turkish scrap importers continued ...

Mining News Pro - SteelMint learned in conversation with industry participants that imported scrap market in Bangladesh ...

Mining News Pro - As per recent updates received from sources, ‘Kanto Tetsugen’- monthly ferrous scrap export tender for ...

Mining News Pro - Imported scrap prices in Turkey have moved up by USD 5-6/MT W-o-W basis, following a recent deal ...

Mining News Pro - SteelMint learned in recent conversation with market participants that imported scrap market in ...

No comments have been posted yet ...