- Write by:

-

Sunday, March 8, 2020 - 11:22:44 AM

-

1379 Visit

-

Print

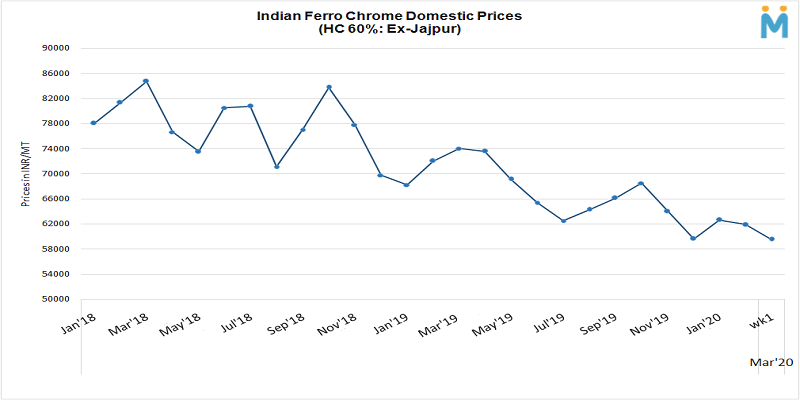

Mining News Pro - Indian Ferro Chrome prices have gone down in line with the depreciated Indian currency against USD

According to Mining News Pro - Indian producers are looking for exports and are willing to lower the prices to conclude deals. There is high anticipation in the market among the highly leveraged producers of clearing the stocks before the Financial year ends. Meanwhile, buyers are negotiating hard and most of the Ferro Chrome producers believe that prices may further fall.

In the domestic market, Ferro Chrome Prices are assessed to be at around INR 59,000-60,000/MT Ex-Jajpur. In the export market, prices remain unchanged due to near to zero transactions. The offers in the market are as under

• CNF South Korea (10-50 mm, HC 60%) is at around 65 cents/lb

• CNF Japan (10-50 mm, HC 60%) is at 66cents/lb

• CNF China, the prices are at around 62cents/lb

Chinese Market:

The Chinese Ferro Chrome market is impatiently waiting for the major Stainless Steel Mills to release their tender prices for the next month. Prices of UG2 Chrome Ore and the spot prices of Ferro Chrome weakened as the demand for Ferro Chrome dampened after the Stainless Steel mills reduced their production. China’s Steel production was largely reduced amidst logistics concern over COVID-19. However, market experts believe that the situation is ought to be sluggish in the near future due to a weak domestic market and the alarming fear of losing the export market following the outbreak in South Korea and Japan, major two Stainless Steel market for China. Producers believe that Ferro Chrome producers are facing a loss, and at this situation, the tender prices may either remain flat or further decline.

Future Outlook

Prices may further decline amid intense selling pressure in the market. Post- OMC Chrome Ore Auctions in India, few market experts commented that past two auctions received highly aggressive bidding, unlike the recent auctions. Most of the producers have sufficient inventory and due to the down-trending Ferro Chrome market, they are unwilling to take any further risk of overstocking.

Short Link:

https://www.miningnews.ir/En/News/498908

A Russian arbitration court ruled on Monday that four units of Swiss commodities trader Glencore will pay more than 11.4 ...

The four largest indigenous communities in Chile’s Atacama salt flat suspended dialogue with state-run copper giant ...

A prefeasibility study for Predictive Discovery’s (ASX: PDI) Bankan gold project in Guinea gives it a net present value ...

Chile’s state-run miner Codelco plans to select a partner for a future lithium project in one of the country’s top salt ...

A Native American group has asked all members of a US appeals court on Monday to overturn an earlier ruling that granted ...

Codelco is exploring more partnerships with the private sector as Chile’s state copper behemoth looks to recover from a ...

Representatives from the Peñas Negras Indigenous community, in northwestern Argentina, clashed with heavily armed police ...

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

No comments have been posted yet ...