- Write by:

-

Tuesday, December 31, 2019 - 10:55:10 AM

-

616 Visit

-

Print

Mining News Pro - Great Panther Mining announced that its Mexican subsidiary Minera Mexicana El Rosario entered into a $10-million concentrate prepayment agreement with IXM Group, one of the world’s largest physical metal traders, headquartered in Geneva, Switzerland.

According to Mining News Pro - The deal entails that IXM’s subsidiary in Mexico commits to purchase 100% of the gold-silver concentrates produced from the Guanajuato Mine Complex in 2020 and 2021. As part of this commitment, the Swiss company agreed to advance a $10-million prepayment to MMR on December 30, 2019.

In a press release, Great Panther said that the prepayment will be repaid on December 31, 2020, and will bear interest at an annual rate of 3-month USD LIBOR plus 5%. There is no hedging of the price of gold or silver associated with the off-take or prepayment agreement.

“We are pleased to be partnering with IXM in Mexico for our GMC concentrates over the next two years,” Jeffrey Mason, the Canadian miner’s interim president and CEO, said in the media brief. “Securing the sale of this off-take at competitive market terms, while strengthening our balance sheet with $10 million at an attractive cost of capital, positions us well to achieve our strategic objectives as we move into 2020.”

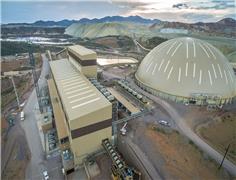

The Guanajuato Mine Complex is Great Panther’s largest operation in Mexico and includes production from the San Ignacio mine, which is processed at the Cata processing plant. It is located within the central Guanajuato District – historically one of the country’s most prolific mining districts, with past production of over one billion ounces of silver and four million ounces of gold since the 16th century.

Short Link:

https://www.miningnews.ir/En/News/464958

First Quantum Minerals, opens new tab on Tuesday offered voluntary retirement to more than 1,500 employees at its key ...

Mining News Pro - Mexican authorities have located remains from two of the 10 coal miners trapped and killed at the El ...

Mining News Pro - Canada’s First Quantum Minerals will carry out maintenance at its Panama mine from Nov. 23 due to coal ...

Mining News Pro - First Quantum Minerals said on Monday it had reduced ore processing at its mine in Panama as protests ...

Mining News Pro - Panama’s ratification of a deal with a copper miner last month should have been a formality. Instead, ...

Mining News Pro - Battered Canadian mining company First Quantum Minerals is bracing for a rocky road ahead as Panama ...

Mining News Pro - Panama’s Supreme Court will consider a lawsuit which alleges that the nation’s contract with copper ...

Mining News Pro - Mexico’s President Andrés Manuel López Obrador exhorted Vulcan Materials’ subsidiary, Calica, to ...

Mining News Pro - US-China tensions are boosting the prospects of a Mexican copper smelter project proposed by Southern ...

No comments have been posted yet ...