- Write by:

-

Sunday, December 22, 2019 - 3:31:18 PM

-

779 Visit

-

Print

Mining News Pro - This week, SE Asia’s billet import prices observed increase. SteelMint didn’t witness any deal across the region. However, billet import offers in the region have marginally gone up by USD 5/MT.

According to Mining News Pro - Rising global billet export offers and Turkey’s imported scrap prices have managed to keep billet market sentiments alive in the region, even in this trade absence week. Although, no hike in Turkey’s imported scrap prices were seen this week amid winter holidays in Europe and US.

Assessment for billet import offers in SE Asia is at USD 445-450/MT, CFR, up USD 5/MT against last week.

Billet export offers from Iran to Thailand were reported around USD 430/MT, CFR basis.

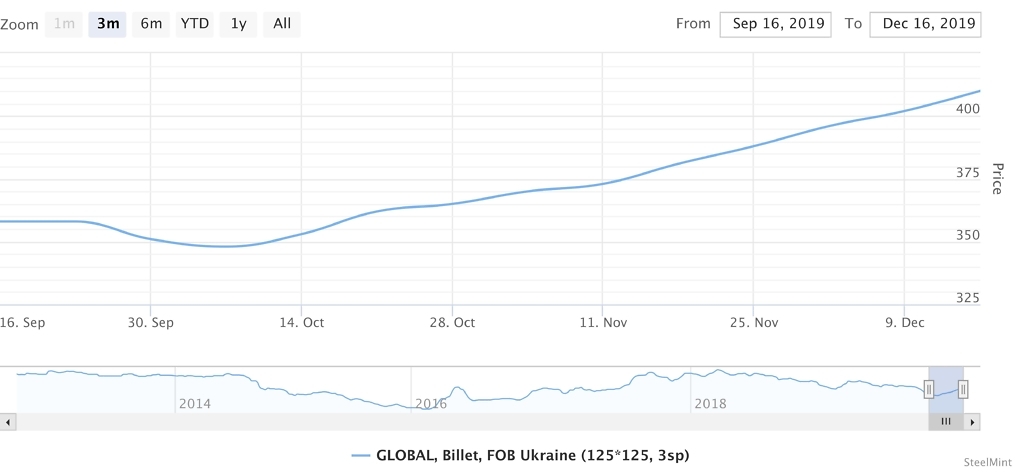

Billet export offers from CIS witness further rise - This week, billet export offers from CIS nations, rose marginally and is standing at USD 405-415/MT, FoB Black Sea, up USD 5-10/MT, against last week. Billet export market sentiments of the country are reported strong.

Vietnam domestic billet offers remain stable- Domestic billet offerings from the country is at USD 420/MT, EXW, identical as last week.

Assessment for US-origin HMS (80:20) now stands at USD 300/MT, CFR Turkey, identical as last week.

Short Link:

https://www.miningnews.ir/En/News/461501

The London Metal Exchange is imposing new rules surrounding the movement of metal in its warehousing network, taking aim ...

A Russian arbitration court ruled on Monday that four units of Swiss commodities trader Glencore will pay more than 11.4 ...

Vietnam’s top miner Vinacomin plans to invest 182 trillion dong ($7.3 billion) to ramp up its alumina-aluminum ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Indonesia’s mining minister on Wednesday said divestment of Vale Canada Ltd and Sumitomo Metal Mining Co. Ltd’s shares ...

Canadian miner Teck Resources has agreed to pay Korea Zinc $165 per metric ton, a three-year low, to turn its zinc ...

Nippon Steel intends to pursue its proposed acquisition of US Steel and wants its “deep roots” in the United States to ...

Russia will regularly buy diamonds from sanctions-hit producer Alrosa through a state fund, the finance ministry said on ...

Indian billionaire Gautam Adani has started operating the first unit of his $1.2 billion copper smelter, the tycoon’s ...

No comments have been posted yet ...