- Write by:

-

Friday, September 27, 2019 - 12:50:01 PM

-

758 Visit

-

Print

Mining News Pro - A test shipment of bitumen oil from Alberta is on its way to China, but it didn’t get to a British Columbia port by pipeline – it was moved by train through Prince Rupert in a semi-solid form commonly known as neatbit.

Melius Energy in Calgary is not the first company to propose moving bitumen through BC in a semi-solid form by train, but it appears to be the first to actually land a potential customer in China and start shipping semi-solid bitumen by train.

It has sent its first container, containing 130 barrels of bitumen, to China in a test shipment, and is currently building a new demonstration plant in Edmonton that turns diluted bitumen into a solid called TrueCrude.

Using existing rail infrastructure, Melius says it could potentially move 120,000 barrels per day of pure bitumen in 100-unit trains through the Port of Prince Rupert.

“Prince Rupert is expanding and they’re looking for lot of containers to move through there,” said Yuri Butler, Melius’ manager of logistics and supply. “That’s one of the reasons we’re excited about working with Prince Rupert is they’re looking for a lot of containers. We’re looking to export a lot of containers. Right now there’s a lot of containers coming into Prince Rupert, but there’s not necessarily a lot leaving.”

Moving bitumen in semi-solid form addresses environmental concerns associated with moving diluted bitumen by rail, pipeline and oil tanker.

The concern is that an oil spill on either land or at sea could have serious environmental impacts. Shipping it in a solid, non-flammable form addresses those concerns. Should a container of TrueCrude ever crack open and end up in the ocean, it would float in one large block that could easily be recovered, the company says.

Bitumen is a thick, tarry form of oil that has to be diluted with lighter oils – condensate – in order to transport it in liquid form. Melius developed a process, called BitCrude, whereby the diluent is taken back out of the diluted bitumen. The diluent can be recycled back to dilbit producers.

The pure bitumen is heated so it can be poured into modified shipping containers, where it then solidifies when it cools. It is then shipped by train and put onto container ships. When it reaches its destination, the bitumen is heated to allow to flow into a refinery.

Melius is currently building a demonstration diluent recovery plant in Edmonton. Butler said the plants could be built and sold as turn-key operations to oil producers in Alberta.

Melius says transporting bitumen by train and container ship is cost competitive with pipeline and oil tanker transport. For one thing, there are no capital costs associated with the transportation, since the railway lines already exist.

“We’re moving on existing rail lines, it’s a safe product and we can efficiently move volume at scale,” Butler said.

There are also economies of scale associated with moving products by container ship, as opposed to oil tanker, since there are so many containers ships plying the ocean.

“When you ship in a container, your costs to ship that container are very competitive because there’s so much volume of containers moving,” Butler said.

He said there is a huge demand in China for bitumen, largely because China’s Belt and Road project will require so much asphalt.

Because of its high asphaltene content, bitumen is a highly desired feedstock for making asphalt. Roughly half of a barrel of bitumen can be turned into asphalt, with the rest being turned into other petroleum products.

“The demand from Asia right now for heavy crude oil is growing and it’s almost insatiable, especially with what’s happening with Venezuela, and Iran and Saudi Arabia,” Butler said.

“They’re looking for supply, and right now they’re struggling to find it. Whereas here in Alberta we have quite a bit of supply and we’re trying to export it to the U.S., where we’re fighting to get a low dollar. If we can get this to the China, we can get a much better dollar and sell our premium product at a premium price.”

Short Link:

https://www.miningnews.ir/En/News/428229

A Russian arbitration court ruled on Monday that four units of Swiss commodities trader Glencore will pay more than 11.4 ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

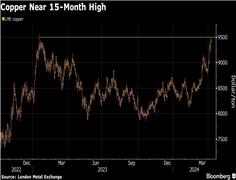

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Iron ore’s reset to around $100 a ton is indicative of a broader reshaping of China’s commodities markets that favors ...

Iron ore reversed direction after dropping to its lowest level in 10 months as optimism that the country’s economic ...

Copper rallied back above $9,000 a ton as investors weighed upbeat factory data from top consumer China and the ...

Shanghai copper prices were little changed on Friday, but poised for their biggest monthly gain in 16 months amid ...

No comments have been posted yet ...