- Write by:

-

Friday, May 24, 2019 - 1:17:30 PM

-

721 Visit

-

Print

Mining News Pro - Copper prices hit their lowest since January on Thursday as fears grew that a worsening confrontation between the United States and China will damage economic growth and metals demand. Benchmark copper on the London Metal Exchange (LME) dropped to $5,880 a tonne in intraday trading, the weakest since Jan. 14, before pulling back to close down just $2 at $5,926.

According to Mining News Pro - Prices were being dictated by a stronger dollar and worries over the U.S.-China dispute, said ING analyst Warren Patterson.

The dollar touched a two-year high on Thursday. A stronger dollar makes metals more expensive for buyers with other currencies. But Patterson said if a trade deal was agreed, solid fundamentals would help copper recover to around $6,900 at the end of the year.

TRADE WAR: The U.S. blacklisting of China`s Huawei has raised concerns that the trade conflict is morphing into a prolonged technology cold war.

British chip designer ARM halted relations with Huawei to comply with a U.S. blockade of the company, while the United States is considering similar sanctions on Chinese video surveillance firm Hikvision. China`s Commerce Ministry said the United States needs to correct its wrong actions if it wants to continue negotiations. The U.S. military meanwhile sent two Navy ships through the Taiwan Strait. MARKETS/OIL: World share prices fell and oil prices slumped.

U.S. ECONOMY: Sales of new U.S. single-family homes fell in April and manufacturing activity slowed to its lowest in nearly a decade in May, pointing to an economic slowdown. GERMANY: German business morale deteriorated more than expected in May, the Ifo institute said.

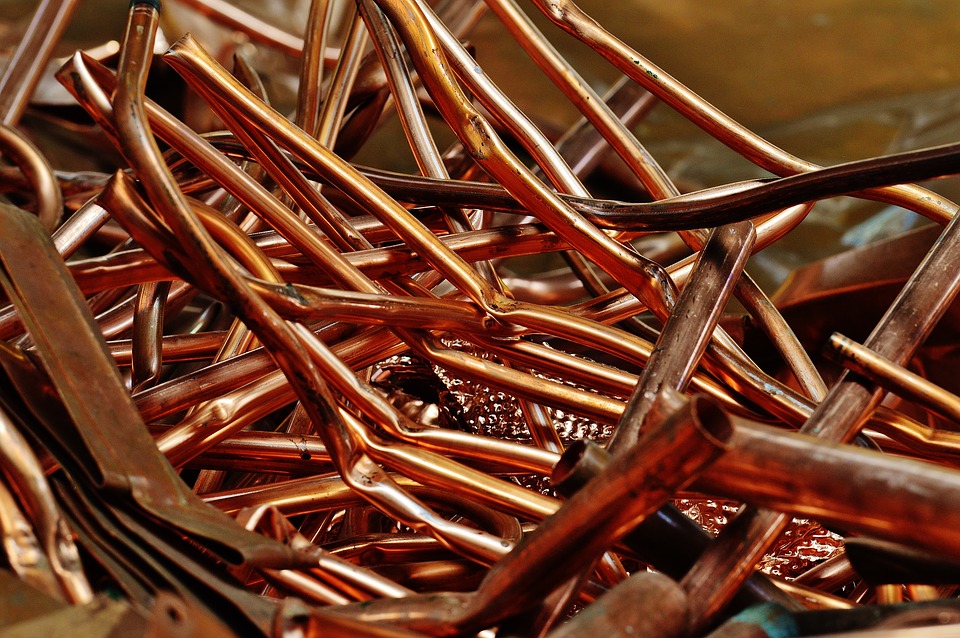

COPPER DEFICIT: The International Copper Study Group said this month the roughly 24 million tonne a year market would see shortfalls of 189,000 tonnes this year and 250,000 tonnes in 2020, potentially supporting prices. CHILE: Coldelco`s huge Chuquicamata copper mine in Chile is set for a 40% drop in production over the next two years, an internal forecast shows. ZAMBIA: Zambia`s 2019 copper output could be as much as 100,000 tonnes lower than last year, the Chamber of Mines said. COPPER SCRAP: China`s imports of copper scrap rose 70% from March to 170,000 tonnes in April while alumina imports doubled to 60,000 tonnes, customs data showed.

OTHER METALS: LME aluminium closed up 1% at $1,797.50 a tonne, zinc fell 0.9% to $2,520, lead rose 0.4% to $1,808 and tin finished unchanged at $19,325. Nickel was not included in closing rings but was down 0.8% at $11,890 in electronic trading.

Short Link:

https://www.miningnews.ir/En/News/379139

A Russian arbitration court ruled on Monday that four units of Swiss commodities trader Glencore will pay more than 11.4 ...

A Native American group has asked all members of a US appeals court on Monday to overturn an earlier ruling that granted ...

Codelco is exploring more partnerships with the private sector as Chile’s state copper behemoth looks to recover from a ...

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

The world’s coal-fired power capacity grew 2% last year, its highest annual increase since 2016, driven by new builds in ...

Peabody Energy Corp. shares sunk to the lowest in seven months after the biggest US coal miner warned that first-quarter ...

Peru’s Las Bambas copper mine, owned by China’s MMG, is facing renewed blockades of a key transport route after failed ...

No comments have been posted yet ...