According to Mining News Pro - High ore prices have lent support to the Silico Manganese prices as our cost of production has gone up sharply, firstly, due to higher global manganese ore offers and secondly, due to the depreciated Rupee making imports costlier, ” said a source justifying the current prices.

“There has been a balanced demand-supply mechanism despite curtailed supply in Durgapur due to power shortages,” said a source referring to demand for the commodity.

Market participants claimed that domestic demand for the commodity is intact, while some suggested export demand to be soft.

SteelMint learned that the domestic producers are trying to match the export offers which resulted in high Silico Manganese prices due to expensive USD.

SteelMint assessed Silico Manganese price at INR 73,500/MT (ex-Raipur) and INR 74,000/MT (ex-Durgapur).

Overseas demand for Silico Manganese is also observed to be sluggish as sellers claim to not have received many inquiries.

The export offers are assessed to be unchanged as well at USD 960/MT FOB India for 60-14 grade and USD 1080/MT for 65-16 grade.

On the future outlook, selling pressure could be on the anvil for Silico Manganese producers due to lower realization, especially in the seaborne market.

Bangladesh Bulk Scrap Imports Up 35% Y-o-Y During Jan-Sept`18 - Port Data

With rising steel capacities and increased dependence on secondary steel production, Bangladesh witnessed sharp rise in scrap imports, on the other hand, 20% regulatory duty imposed by the government on overseas purchase of steel billets in addition to 15% VAT, bulk billet imports moved down significantly in CY18.

Bulk ferrous scrap imports up 35% Y-o-Y during Jan-Sept’18 - As per ports data for bulk vessels, the country imported 797,584 MT bulk ferrous scrap during Jan-Sept’18 against 588,634 MT during Jan-Sept’17. Top exporters of ferrous scrap were USA (69%), UK (14%), Japan (10%) and Russia. Chittagong remained topmost unloading port for all commodities imports.

Since last year steel producers have bolstered domestic billet production to meet the growing demand. To a great extent the country has attained virtual self-sufficiency in billet production however this has been achieved solely through the induction furnace route and with the use of imported scrap.

Bulk DRI and Pig Iron imports up sharply Y-o-Y during Jan-Sept’18 - Bangladesh imported 274,730 MT bulk DRI, up 168% Y-o-Y during Jan-Sept’18 as against 102,660 MT while Pig Iron imports rose 94% Y-o-Y to 91,500 MT against 47,250 MT during same period last year. Leading steel mills and re rolling mills are making fresh investments to raise their steel capacities which has resulted in increased sponge iron exports from India to Bangladesh.

Bulk steel billet imports down 17% Y-o-Y during Jan-Sept’18 - Bangladesh bulk billet imports recorded at 103,867 MT, down 17% as against 125,700 MT during Jan-Sept’17. Bulk billet imports fell from 1 MnT in FY16 to just 0.1 MnT in FY18.

Highlights for September bulk imports to Bangladesh -

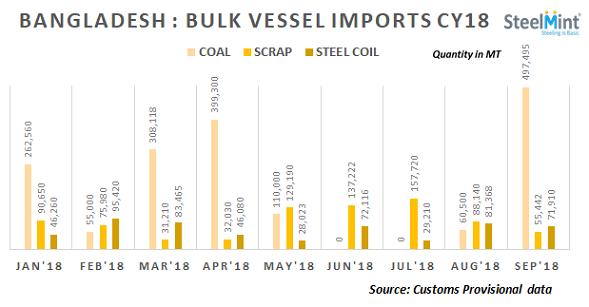

Bangladesh bulk Coal imports hit highest in Sept’18 since Dec’17 - The country imported 497,495 MT coal in Sept’18, up 722% M-o-M as against just 60,500 MT in Aug’18. Indonesia supplied highest occupying total 60% share of total coal imports while another leading supplier South Africa witnessed 76% M-o-M rise in its coal exports to Bangladesh in Sept’18.

Bangladesh bulk steel coil imports down by 11% M-o-M in Sept’18 - The country imported 71,910 MT steel coil in Sept’18, down 11% M-o-M as against 81,368 MT in Aug’18.

Bangladesh bulk scrap imports fall to 4-month low - Cheaper domestic scrap, sluggish rebar demand on slowdown in construction activities and religious festival holidays reduced bulk scrap imports in Sept’18. Bangladesh imported 55,442 MT bulk scrap in Sept’18, down 37% as against 88,140 MT in Aug’18.

India’s MMTC exported a bulk shipment of Pig Iron to Bangladesh in Sept’18 - India’s MMTC on behalf of NINL observed a bulk shipment to Bangladesh comprising 16,500 MT in Sept’18 as against nil imports recorded in Aug’18.

Notably, the country observed no bulk shipment berthed for Billet and HBI in Sept’18 successively for the second month since Aug’18.

Commodity wise Bangladesh Bulk imports in CY18 –

| Commodity | Jan-Sept`18 | Jan-Sept`17 | % Y-o-Y Change | Q1-FY19 (Jul-Sept`18) | Q4-FY18 (Apr-Jun`18) | % Q-o-Q Change |

| Coal | 1,692,973 | 1,137,400 | 48.85% | 2,010,620 | 2,581,818 | -22.12% |

| Scrap | 797,584 | 588,634 | 35.50% | 757,364 | 1,112,912 | -31.95% |

| DRI | 274,730 | 102,660 | 167.61% | 255,310 | 343,760 | -25.73% |

| HRC | 553,852 | 624,560 | -11.32% | 899,300 | 749,967 | 19.91% |

| Billet | 103,867 | 125,700 | -17.37% | 236,950 | 131,700 | 79.92% |

| Pig Iron | 91,500 | 47,250 | 93.65% | 69,500 | 81,500 | -14.72% |