- Write by:

-

Friday, August 24, 2018 - 9:02:45 AM

-

1093 Visit

-

Print

Mining News Pro - In the last four months gold prices have dropped by more than 12%, losing 3% this month alone.. Despite the downtrend, the World Gold Council (WGC) sees potential for a recovery later in the year.

In the last four months gold prices have dropped by more than 12%, losing 3% this month alone.. Despite the downtrend, the World Gold Council (WGC) sees potential for a recovery later in the year.

In an investment update report, the WGC said increased consumer demand and reversal of extreme bearish speculative positioning could help push gold prices up from their recent 1.5-year lows. The report added they see potential for a rebound even in the face of a strong U.S. dollar.

The comments come as gold struggles to find momentum from last week`s low. December gold futures last traded at $1,191.90 an ounce, down almost 1% on the day.

“The dollar`s strength has been one of the most important drivers of gold`s performance this year as confrontational trade rhetoric and sanctions has so far played in favor of the U.S.,” the analysts said. “But gold may rebound due to both technical and fundamental reasons.”

According to the council, gold’s biggest strength for a near-term rally could come from its biggest weakness. They noted that bearish speculative positioning is at historic highs, which isunstainable.

“In recent years, a large increase in short positions has been followed by a sharp rally in gold. And while net shorts were more prevalent in previous decades, there have been structural changes that make these positioning levels different and likely short lived,” the report said.

The WGC noted that growing demand from India and China -- which is 50% of the global market – a shift in miners’ hedging practices and the metal’s low opportunity costs as bond yields hover around 3% are all reasons that could help reverse gold’s current fortunes.

“But a bounce back in the gold price can only be sustained if there are fundamental reasons to encourage consumers and long-term investors to seek exposure to gold,” the report said.

Looking ahead, the WGC said that growing geopolitical risks due to rising global trade tensions, apprehension over equity market valuations, low interest rates coupled with rising inflation pressures, and a flattening yield curve in the U.S. could all create fundamental demand for the yellow metal.

“A period of heightened geopolitical risk with the potential to impact the global economy could, thus, be supportive of gold even if the dollar were to strengthen,” the analysts said. “Gold could trade lower if the US dollar increases its strength, but in the light of positioning in US, and increased interest from buyers in China and India, the risks seem skewed towards a recovery.”

Short Link:

https://www.miningnews.ir/En/News/243913

Mining News Pro - Michael Nowak was once the most powerful person in the gold market.

Mining News Pro - The Bank of Russia said it will start purchasing gold again, just under two years after it ended a ...

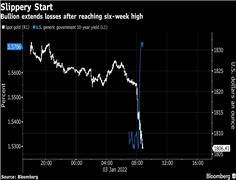

Mining News Pro - Gold extended its decline heading into 2022, falling by more than 1% on Monday as a risk-on rally in ...

Mining News Pro - Gold edged lower as investors weighed mixed labor data from the U.S., the Federal Reserve’s hawkish ...

Mining News Pro - Gold erased more than two weeks’ worth of gains on Monday, pressured by a firmer dollar and ...

Mining News Pro - Spot gold prices have hit another five-month high – the second time in 2021 they’ve peaked at such an ...

Mining News Pro - Gold demand fell 7% year-on-year and 13% quarter-on-quarter to 831 t in the third quarter, primarily ...

Mining News Pro - Gold prices held firm on Monday near the key level of $1 800 as a drop in the US dollar bolstered ...

Mining News Pro - The mandatory hallmarking for gold jewellery and gold artefacts that became effective in June, has ...

No comments have been posted yet ...