- Write by:

-

Monday, July 9, 2018 - 1:48:26 PM

-

1863 Visit

-

Print

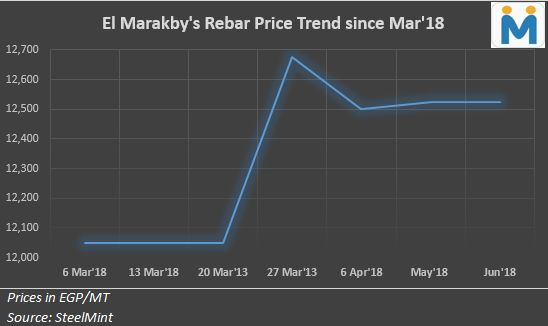

Mining News Pro - After the haphazard movement in Egypt’s rebar prices in the month of Mar and Apr’18, no variation can be seen since then. According to the SteelMint sources, the rebar prices continue to remain unchanged over the past two months

The last offers for rebar from country’s biggest rebar producer, Ezz Steel was heard at EGP 12,525-12,528/MT (USD 700-702/MT) while another major domestic producer, Beshay Steel, is offering rebar at EGP 12,525 per tonne (USD 701/MT). These prices are on ex-works basis and include VAT of 14%.

Egypt is majorly dependent upon imports from CIS region to meet its raw material (billet) requirement for rebar. After a month-long holy month of Ramadan which ended in Jun’18, it was anticipated that the billet demand in the country will pick up and so will its prices. However, as per market sources, the steel demand in the country is quite tepid at present due to which the imported billet offers have registered a fall of USD 5-10/MT w-o-w basis.

The current offers for the same are being heard at USD 515-520/MT, FoB Black Sea.

Egypt has announced new cuts to electricity subsidies in the month of June, raising prices by an average of 26% from the new fiscal year starting from 21 Jul’18. According to the reports, Egypt has committed deep cuts to energy subsidies and other tough fiscal measures as part of a three-year, USD 12 billion International Monetary Fund (IMF) loan programme that began in 2016. The government said that the fuel price rises would have to rise in July to keep the subsidy reform programme on track and that the electricity subsidies will be phased out completely by the end of the 2021-2022 fiscal year.

Subsequently, industry participants believe that this hike in the country’s electricity charges may trigger a rise in Egypt’s domestic rebar prices in the new fiscal year. However, if country’s demand for steel continued to remain subdued, the rebar manufacturers will have limited scope to increase their rebar offers and may have to bear the burden of increased raw material (fuel) cost.

- Source: www.steelmint.com

Short Link:

https://www.miningnews.ir/En/News/210126

No comments have been posted yet ...